Covid-19 related crisis: an update of the situation

Very heavily affected by the Covid-19 related crisis, the global economy should witness in 2020 its most severe recession since World War II. In fact, the World Bank predicts a historic drop in GDP across the globe, before a probable rebound forecast for 2021. In Morocco, the situation is likewise highly concerning. After several months of confinement, the prospects remain uncertain and several sectors of the economy look forward to re-starting quickly.

The Covid-19 health crisis has deeply upset the economic juncture during the first quarter of 2020. According to the World Bank’s “World Economic Prospects,” international economy should witness a strong slow down with a contraction of the GDP by 5.2% in 2020, on account of the “massive and brutal shock provoked by the Coronavirus pandemics and by the lockdown measures taken in order to suppress it.”

A Historic Global Recession

In advanced economies, the recession would be -7%, according to the World Bank, while in emerging and developing economies, it would be limited to -2.5%. Accordingly, 71 million people would fall back into absolute poverty, notably in Sub-Saharan Africa and South Asia. Moreover, according to this international institution, everyone should wait for 2021 before one could see any economic recovery, with a growth rate averaging 4.5% across the world: 3.9% in the more advanced economies and 4.6% in emerging and developing countries. In this scenario, ebbing pandemics would be sufficient for the lifting up of national restrictions in the weeks ahead. On the other hand, if the pandemics should continue, or in case of a second wave, the situation would become all the more complex.

A Drop in the Moroccan GDP in 2020

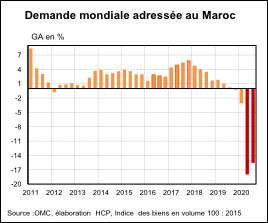

Particularly affected, after several months of confinement, Morocco is also undergoing some difficulties related to uncertainties concerning the opening of its borders and tourism. According to the WB, the Kingdom’s GDP should drop by 4% in 2020, but the forecasts remain very uncertain. The second quarter has been particularly tough with a contraction of 13.8% in the national economy according to the Higher Commission in charge of Planning (HCP). This drop may be accounted for by the very low activity of secondary and tertiary sectors: non-agricultural value has thus shrunk by 14.4% during this period. As for agriculture, which employs the majority of the country’s active population, it has decreased by 6.1%. Moreover, the Kingdom must brace up for an 18% fall in foreign demand, mainly in the automotive and aeronautics sectors—which seriously hampers its industrial activity, obviously.

World Demand addressed to Morocco

Source: WTO, elaboration by HCP, Goods indicator in volume 100, 2015

The Kingdom in search of a Rebound

Nevertheless, and as has been pointed out by the Financial Research and Forecasts Directorate (DEPF) at the Ministry of Economy and Finance, in its juncture note for the month of June 2020, “the steady restart of the post-confinement business, associated with massive re-launch measures should be able to sustain economic recovery.” The third quarter should thus witness a mitigation in the drop registered in non-agricultural value-added, thanks to the resumption of commercial and industrial activities. Moroccan companies are also getting ready for a gradual upturn depending in the evolution of the sanitary situation. Nevertheless, not all sectors are on the same boat, of course: some could rebound quickly whilst others run the risk of undergoing a protracted crisis.

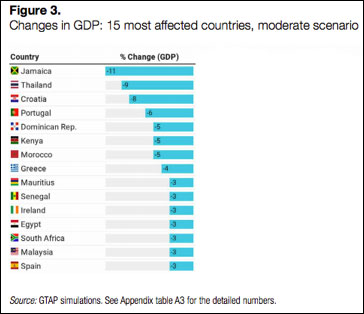

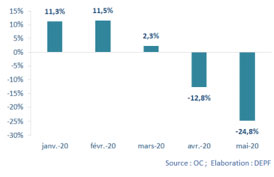

Tourism without Visibility

Among the sectors that have been hardest hit, tourism stands out as a casualty. Practically idle for three months, the professionals in the sector are betting on the domestic market in order to make up for the prolonged absence of foreign tourists. In fact, total opening of the borders has not been scheduled yet but the summer season is already under way. According to the National Tourism Confederation (CNT) and the National Hotel Industry Federation (FNIH), the sector has already lost more than 30 billion Dirhams and roughly 500,000 jobs. Moreover, in a recent study, the UN Conference on Commerce and Development (CNUCED) explains that Morocco will be the 7th most severely affected country in terms of tourism, fearing that as much as 110 Billion Dirhams might be lost during the year 2020.

Evolution of Cumulated Tourist Revenues

The Aeronautics and Automotive Sectors are waiting

This unprecedented confinement observed by countries across the world has directly impacted air transportation. Consequently, airline companies have frozen their investments and devised social plans in the hope of surviving the crisis. This is notably the case of Royal Air Maroc which has just announced important austerity measures. More broadly speaking, the aeronautics industry has also to reckon with a drop in orders. In Morocco where the sector has become one of the engines of exports, the business has decreased by 30-50%. Numerous equipment manufacturers and suppliers are waiting for the re-start of the business which should take place soon after the resumption of international flights.

The situation should evolve a bit more quickly in the automotive sector, which was on a standstill during the confinement, too. According to the General Confederation of Companies in Morocco (CGEM), 71 billion Dirhams in turnover have been lost and approximately 150,000 jobs are threatened. As a major sector of the Moroccan industry, with numerous exports every year, the automotive sector is awaiting a signal from major manufacturers. Here again, equipment suppliers based in Tangiers, Casablanca, and Kenitra are impatiently watching the trends and hoping for a recovery.

Steady Recovery in the Other Sectors

According to the High Commission in charge of Planning (HCP), aside from these sectors, the 3rd quarter should allow for an upturn in the national economy, though the latter will not witness the same trends observed prior to the crisis. Foreign demand addressed to Morocco “would improve by 3%, compared with the 2nd quarter, but its drop, in terms of annual variation, would be in the range of -15.6%.” Similarly, “domestic demand would recover moderately and slowly.”

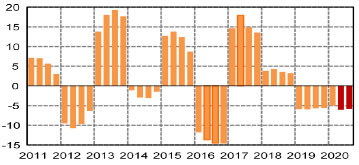

The added value of agricultural activities should continue to decrease but without resulting in any increase in food inflation. “Local agricultural offer, though on a downward trend compared with the same period a year previously, would continue to outstrip demand in terms of market-garden crops, fruit crops, and animal production.”

In the secondary sector, the drop in activity should be -5.8%. The decrease in industrial value added would be mitigated, “with the resumption of industries geared towards the domestic market, but the prospects of slow recovery in foreign demand will continue to weigh in on the industries that are oriented towards exports.” As far as mining is concerned, the drop in agricultural consumption across the world would curb the dynamics of international demand for fertilisers, in the context of poor global economic performance. “The production of non-metallic ore would adjust to a less vigorous external demand, resulting in a slow-down in the increase of the mineral added value by +0.1% during the 3rd quarter of 2020.”

Finally the tertiary sector should benefit from the dynamics of the communications and non-marketable services sectors, and to a lesser extent, from the recovery of the commerce and transport business, while it would remain subdued in the events-organization and accommodation services. “Overall, the value added in the tertiary sector would edge down by 1.6% in annual variation, compared with a 3.8% increase during the same period a year previously.”

The HCP insists that these forecasts remain subject to more or less significant revisions, depending on the evolution of the situation, which is still very uncertain.

Agricultural added value

Year-on-year in %

Source: HCP