Within a few decades, Morocco has become an attractive and competitive destination in the automotive sector by rising to meet international standards. The country has steadily managed to develop its industry by developing a long-term vision and creating winning synergies around liberal policies. But how has the “Made in Morocco” positioned itself in a highly competitive sector? And what challenges are yet to be raised by it?

All Indicators are Green:

The figures in the automobile sector reflect dramatic and highly promising dynamics. With an export turnover upwards of 70 billion Dirhams in 2019, the sector represents a little more than a quarter (26%) of the Kingdom’s exports, well ahead of phosphates. In 2019, the number of vehicles produced in Morocco added up to 394,000 units, compared with a little fewer than 60,000 units in 2011. This level of production consecrates the Kingdom as the African leader in the automotive sector. By 2023, the total car production capacity in Morocco will be 700,000 units per year. In terms of job creation, the figures are eloquent, too, with 116,000 jobs generated between 2014 and 2018, which accounts for 27% of industrial jobs. To achieve such performances, the “Made in Morocco” has gone through several stages.

In spite of the impact of the COVID-19 on this sector in 2020, it is expected that recovery will be timely, supported as it is by a Sector-based Recovery Plan which is aimed at stimulating offer and demand and follow through investment in this sector.

A Booming Industry

About a century old, the automotive industry has benefitted from the special attention of His Majesty, King Mohammed VI, since his accession to the throne. The interest was translated in 2003 by the transfer of the public shareholding in SOMACA to the French automaker, Renault. In 2007, two years after the adoption of the (Industrial) Emergence Plan, the Kingdom signed a historic agreement with the Renault-Nissan Alliance providing for the construction of a large car assembly production unit in Tangiers.

It must be said that the Morocco destination possesses a number of undeniable assets: a privileged and strategic position at the cross-road of major maritime routes; a stable and secure political context; an attractive economic environment; numerous infrastructures built to the best international standards; as well as qualified and competitive workforce.

In spite of the 2008 economic crisis, the project materialized on April 6, 2012: the first car rolled off the production lines to be exported via the new Tanger-Med harbour platform, lying just a few kilometres from the car-manufacturing plant.

An Industry that is becoming all the more attractive …

After Renault, other major automakers have chosen Morocco to set up business. In June 2015, the French Group, PSA Peugeot-Citroen signed an agreement with the Kingdom for the creation of a factory on the Atlantic Free (Trade) Zone, close to Kenitra. Four years later, in 2019, His Majesty King Mohammed VI inaugurated the plant. The latter constitute the heart of a dynamic ecosystem which is chalked to produce 200,000 cars per year and to create 4,000 direct jobs and 20,000 indirect ones.

The setting up of PSA in the country further strengthens the weight of Morocco on the world automotive industry map. In the PSA plant, the share of Made in Morocco has not ceased to gain in importance. Thus, the production of the new Peugeot 208 car has been accompanied by 60% local integration rate, a record! The ambition now is to attain an 80% local integration rate with actual auto engine assembly.

The Development of a whole Ecosystem

In the wake of the advent of automakers, an entire ecosystem made up of subcontractors has emerged. Accordingly, a number of major international suppliers such as Snop, Valeo, Takata, Lear, Saint Gobain, Denso and others have set up business in the regions. And a number of Moroccan small and medium-sized companies have followed suit to supply automakers with components such as wheel rims, dash-boards, shock-absorbers … Companies like Dolidol, Afrique Cables, Maghreb Steel, Floquet Monopole, CFD, Sinfa, Tuyauto, GPC and others have taken advantage of this automobile boom to develop. For example, Afrique Cables, a subsidiary of Ynna Holding, with its electric batteries, has become a direct subcontractor of Renault. Another example: Dolidol, a subsidiary of Palmeraie Group, now produces technical foam designed for car sound insulation purposes.

But this dynamics is yet to be consolidated because, notwithstanding these performances, Morocco must face up to completion in an ever changing global context. The country’s exports are ranked 27th worldwide and have to contend with fierce competition notably on the part of some East-European countries and Turkey.

The 4 Major Challenges facing the Automotive Sector in Morocco

The major stake for Morocco consists in transforming the constraints which weigh upon this industry into real business and development opportunities. In this automotive sector, which now stands at a cross-road, there are presently four major challenges to be met.

Challenge no. 1: Developing Local Integration

According to World Bank experts, the first challenge is that of local integration. It is essential for the Kingdom to integrate and develop a local ecosystem so as to generate jobs and develop its regions. The wealth created is still very often claimed by foreign investors and the real impacts on the local fabric are still not adequate. An in-depth integration would make it possible to increase young graduates’ integration rate and shore up Moroccan entrepreneurship. The integration of components manufactured in Morocco is a fundamental component of the competitiveness of automotive industry.

Challenge no. 2: Accelerate the Upsurge of Competency

The surge of competence constitutes another lever of development. In fact, the workforce should not solely be dedicated to the assembly of parts, connectivity network, or other components. The country must considerably invest into training and the development of competencies in order to capture the wealth that is generated in this sector. Orienting young people towards innovative trade-lines; training the workforce in future-geared technological competence; creating foot-bridges between the academic and the professional worlds represent some priority objectives that should be attained in order for Morocco to gain in competitiveness and boost its added value. In this area, companies have a key role to play by providing better learning and apprenticeship conditions for the young.

Challenge no. 3: Diversifying Export Markets

The third major challenge resides in the diversification of export markets by incorporating other developing countries, notably in Africa. In fact, according to the International Finance Corporation (IFC), “the dependence of Morocco on European export markets increases its vulnerability to changes occurring on the global scale.” Moreover, the European market tends to slow down and the competition on the continent is particularly intense. Morocco must therefore capitalize on its positioning as a strategic hub geared towards Africa in order to conquer new emerging markets where demand is strong.

Challenge no. 4: Anticipating Technological Changes

Finally, the increasing demand for hybrid or electrical cars offers strong growth opportunities. In this area, the signing of a memorandum of understanding with BYD, a Chinese automaker, constitutes an encouraging sign for the development of the electrical transportation sector. More generally, the industry should anticipate major technological changes and the emergence of new types of vehicles by fully engaging in tomorrow’s trade-lines. To achieve these objectives, the country should invest more massively in Research and Development.

As a pillar of the economy, the automotive sector seems to be at the crossroads. The Kingdom has all the cards in hand to develop a high performance ecosystem, one that is recognized on the global scale. The next Industrial Acceleration Plan spanning 2021-2025 will bring to the fore new growth areas and the means to take advantage of them.

For the time being, why not imagine a car that is 100% Made in Morocco? An economical electrical vehicle which could be exported all over Africa? While the route to excellence is still long, the reasons for being optimistic are numerous. In this industry, like most other sectors of our economy, the winning companies will the ones to bet on innovation and to show the capacity to anticipate changes.

90% of the Moroccan automobile production is exported worldwide, of which 80% are intended for European countries.

The manufacture of hybrid or 100% electric vehicles is chalked to be multiplied six folds by 2025. Accordingly, 4 million such cars will be manufactured, which accounts for 22% of the overall European automotive industry, compared with just 4% today.

|

1st Exporting Sector |

More than 72 billion Dhs export turnover in 2018 |

More than 116,000 Jobs created between 2014 and 2018 |

|

Upward of 60% of Local Integration |

|

1st Construction Hub on the African Continent |

http://www.mcinet.gov.ma/fr/content/automobile

Annual Automotive Production Capacity per Period (In Units)

|

SOMACA Plant, Casablanca |

RENAULT-NISSAN Plant, Tangiers |

PSA Plant in Kenitra |

Source: Data provided by the Ministry in charge of Industry, Trade, Green and Digital Economy, Article from January 31, 2020

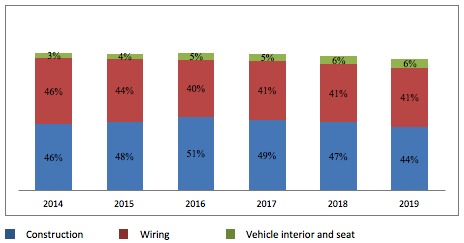

Evolution of the export structure of the automotive ecosystem 2014-2019

Number of vehicles produced by country between 2011 and 2018

Morocco: 1 944 988

Hungary: 3 093 562

Romania: 3 062 368

South Africa: 4 060 008

Source : https://www.finances.gov.ma/Publication/depf/2020/Etude-industrie-automobile.pdf